With IRS reminder letters going out to millions of people and under three weeks remaining for families to claim the expanded Child Tax Credit (CTC), Earned Income Tax Credit (EITC), and third stimulus payment through GetCTC.org, many people may be asking: how do I know if I have received the 2021 CTC? Please read below for Frequently Asked Questions on this topic. Refer to this as you work with families to determine what they need to do, if anything, to claim this money. We have provided visuals that you can share with families to help them confirm which payments they have already claimed.

I did not receive monthly CTC payments in 2021 and have not yet filed a 2021 tax return. How can I claim my CTC?

If you did not receive monthly CTC payments last year, you can claim your full 2021 CTC by filing a 2021 tax return. The CTC is worth up to $3,600 for each child under 6 and up to $3,000 for each child between 6 and 17. The easiest way to file a 2021 tax return is to submit a form online through GetCTC.org by November 15th. This website is available in English and Spanish, and on your phone and computer. It generally takes just 15 to 30 minutes to complete the form.

If you do not claim this money by November 15th, you can still get the CTC, but will need to file a full tax return. Most tax services, including Volunteer Income Tax Assistance (VITA) sites, which help families file tax returns for free, will reopen in January. You should call a local VITA site in advance to ensure they can help you file a 2021 tax return, in addition to the current year’s return.

I received monthly CTC payments in 2021, but have not yet filed a 2021 tax return this year. Is there more money for me to claim?

Yes. You likely are entitled to additional money. If you want to confirm how much you received in last year’s CTC monthly payments between July and December 2021, you can review the IRS Letter 6149 that you should have received earlier this year, check your online IRS account, or look at your bank account records. You should have received half of your total CTC through these payments. For example, if you have one child under the age of six, you are entitled to $3,600 through the full credit. In 2021, you should have received monthly payments totaling $1,800. You now must file a 2021 tax return in order to claim the second half.

If you did not receive the full amount of the CTC you believe you should have through 2021 monthly payments, you can claim the remaining amount you are owed when you file your 2021 tax return. The easiest way to file a 2021 tax return is to submit a form online through GetCTC.org by November 15th. This website is available in English and Spanish, and on your phone and computer. It generally takes just 15 to 30 minutes to complete the form. If you are not sure how much you received in 2021 monthly payments, you can give your best estimate when using GetCTC.org. If you provide the wrong amount, your refund may be delayed, but there will not be a penalty.

If you do not claim this money by November 15th, you can still get the CTC, but will need to file a full tax return. Most tax services, including Volunteer Income Tax Assistance (VITA) sites, which help families file tax returns for free, will reopen in January. You should call a local VITA site in advance, to ensure they can help you file a 2021 tax return, in addition to the current year’s return.

I already filed a 2021 tax return this year. How do I know if I received the CTC?

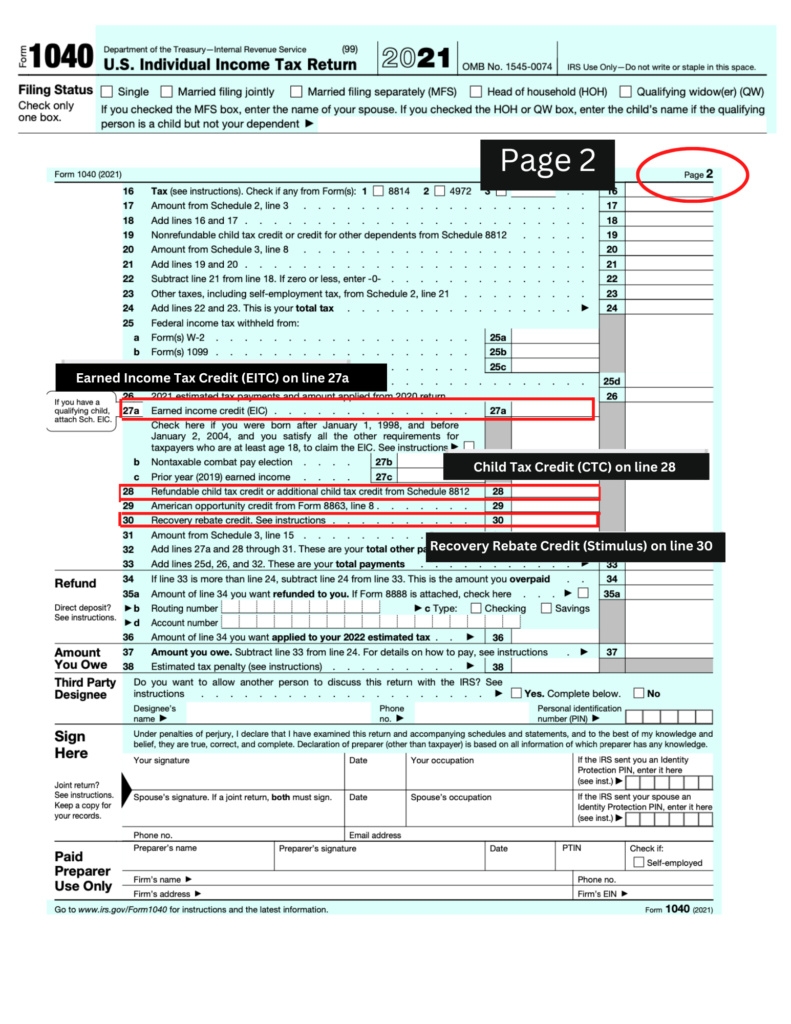

If you already filed your 2021 tax return and are wondering if you received the CTC, you can take these steps to ensure you claimed the credit (and other money to which you are entitled) and received your refund:Step 1 Check line 28 on IRS Form 1040 to see if you claimed the credit. See below for an image that shows where you can see if you claimed the CTC (line 28), the Earned Income Tax Credit (line 27a) and the stimulus payment (line 30). If you do not have a copy of your 2021 tax return and someone helped file for you (like a tax preparer or a Volunteer Income Tax Assistance site), you can contact them to get a copy. If you cannot secure a copy of your return in this way, you can request a copy from the IRS. Learn more here.

Step 2 Go to https://www.irs.gov/refunds and click “Check my refund status.” This “Where’s My Refund?” tool will inform you if/when your refund was issued and if the IRS sent a letter describing next steps (if there was something about the return that required extra steps).

If you claimed the CTC on your return and received your refund, you have most likely received the 2021 CTC. No further action is needed. If you did not claim the CTC, you can get it by amending your return after it has been processed. Please see Question 6 to learn more.

What if I claimed the CTC on my 2021 tax return, but did not receive the credit?

If you claimed the CTC on line 28 of Form 1040 in your tax return and you received your refund, you have most likely received the full CTC to which you are entitled. On occasion, the IRS may determine you are eligible for a lower amount or no additional CTC. This might happen for example, if you accidentally misreported the amount you received in monthly payments in 2021 or if the number of dependents you claimed in 2020 was different than what you claimed last year. If this is the case, the IRS will send a letter explaining the adjustment and if you are still owed a refund, issue the updated amount.

In some cases, the IRS may use all or a portion of your refund (including the CTC) to offset a debt you have with the IRS or another federal agency. If this happens, you will receive a notice from either the IRS or Bureau of the Fiscal Service explaining that a certain amount of the refund has been used to pay off past debt. If you disagree with the amount of the refund the IRS calculated or the amount of debt owed, you can seek assistance from a Low-Income Taxpayer Clinic (LITC). LITCS supports individuals with low incomes who have tax issues with the IRS. You can find an LITC location near you here. It is important to call an LITC site in advance to confirm that they can support you. Please note that some phone numbers listed on this LITC locator may be out-of-date. If this is the case, we recommend Googling the name of the LITC for updated contact information.

What if I filed a 2021 tax return, but did not receive my tax refund?

If Where’s My Refund? says a refund was issued, but you did not receive it as a direct deposit to your bank account or through a check, you can request that the IRS do a refund trace. You can find more information on that process here.

What if I did not claim the CTC on my 2021 return? Can I still receive it?

If you filed a 2021 tax return, but did not claim the CTC, you can file an amended return to get what you are owed (learn more here about amending returns). The tax preparer or service that helped you file your original return may be able to support you with the amended return. If you choose to use a paid service to do your amended return, keep in mind these tips for selecting a trustworthy preparer. You can also contact a local Volunteer Income Tax Assistance (VITA) site to check if they would be able to help you file an amended return. Most of these free tax assistance sites will reopen in January. You can find the closest site here. It is highly recommended to call before going to confirm they can help you, because many sites will not have this capacity.