Check out this short video about IRS Letter 6550 and how families can claim the money for which they are eligible. Please share this widely with families and partner organizations!

With one month until simplified filing through GetCTC.org closes on November 15th, the IRS announced that it will send letters to over 9 million individuals and families who likely qualify for the expanded Child Tax Credit (CTC), Earned Income Tax Credit (EITC) and third stimulus payment (2021 Recovery Rebate Credit), but have yet to claim them by filing 2021 federal tax returns. These letters will start going out this week, and can help move millions of people to take action to claim their money. As a trusted source of tax information for families, the IRS is particularly well-positioned to encourage millions of families to claim the money for which they are eligible. You can help make this outreach successful by letting families know they may be receiving letters in the mail, confirming the validity of these communications, encouraging people to act now to get this money and letting them know how to do so.

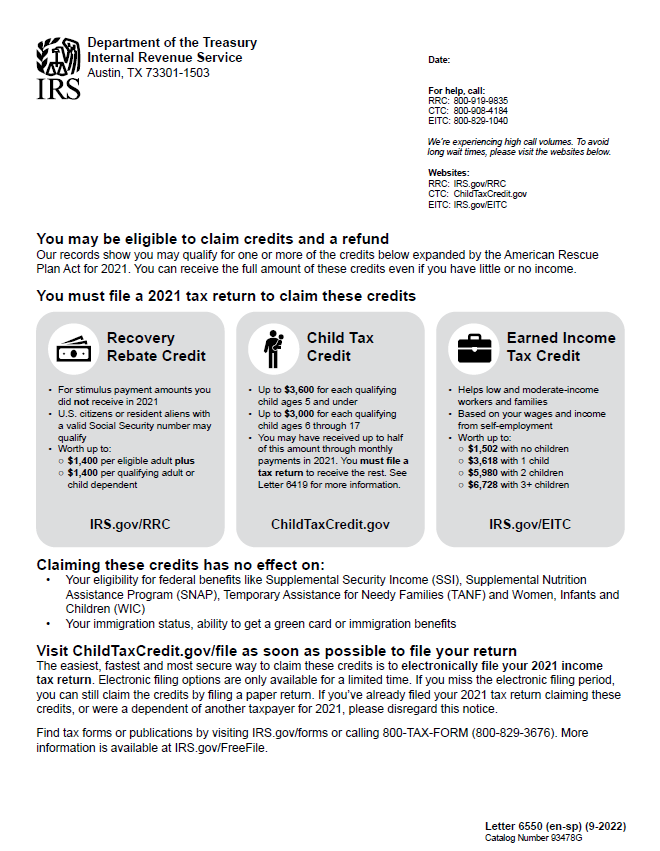

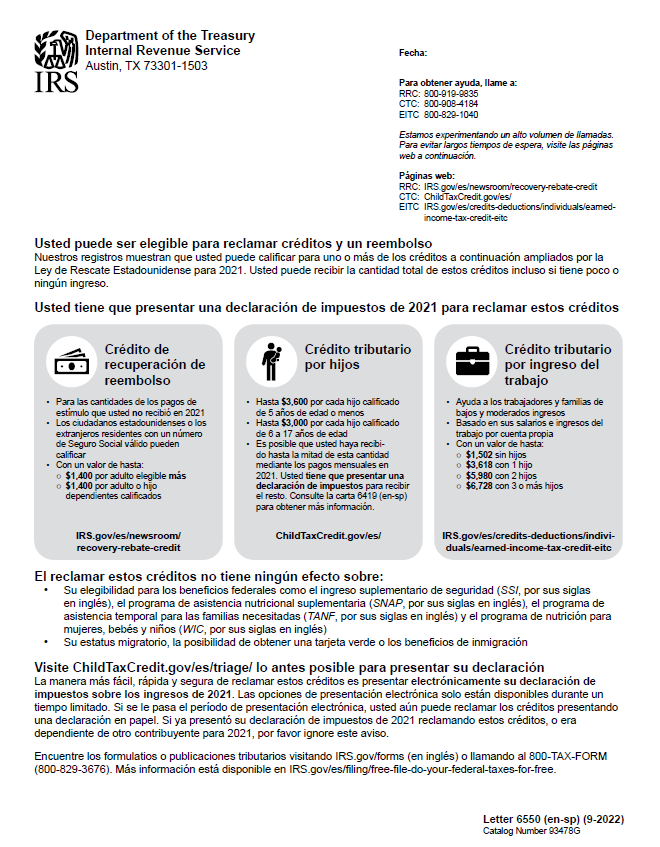

As you spread the word to families about the CTC in the coming weeks, you may receive questions from individuals who receive letters. To help you anticipate these questions, we have included a copy of IRS Letter 6550 in English and Spanish here and below. You will see that the letter alerts recipients to this opportunity, provides an overview of the available benefits and addresses common concerns.

As you will note, the letter provides a number of different links to web pages with further information about the available funds. While these web pages provide helpful information, they do not all include a clear way for families to actually claim this money. We believe you can play a critical role in addressing potential confusion by directing people to where they can file. As you interact with families in the coming weeks, we encourage you to convey the following key points about how they can get the money to which they are entitled:

- You must file a tax return to claim this money.

- To get it as quickly and easily as possible, file by November 15th.

- As indicated at the bottom of the letter, you can go to ChildTaxCredit.gov/file, to get all of the payments – even if you do not have children.

- Once you are on that page, you’ll have two options for how to get the money:

- Option 1: You can apply with a simple form on GetCTC.org. This may be a good option for you if you want a quick and easy way to apply.The site is in English and Spanish, and you can file using your phone. There’s even live chat support if you need help.

- Option 2: You can file a full tax return via IRS Free File.This option may be best for you if you feel comfortable using a computer, have all your tax documents and feel comfortable filing with limited help. This process may allow you to claim additional money, for example state credits.

After GetCTC.org closes on November 15th, families can still claim this money until 2025, but will need to file full tax returns to do so.

We know how effective it is for families to receive information from multiple trusted sources. You can spread the word about this opportunity using multilingual outreach resources like these. With just a month until GetCTC.org closes, now is the time to help families access thousands of dollars.

To learn more about the IRS’s outreach efforts and how it has identified letter recipients, check out this IRS news release.